Donate

Grow Our Community

Where the Need is Greatest – Three Valleys Community Foundation

Unrestricted gifts to 3VCF provide a pool of available resources to carry out our critical work and advance our mission. These funds will be directed to where they are needed most.

Corporate Challenge

Three Valleys Community Foundation is pleased to announce the launch of our 2nd annual Power of Collaboration Campaign – a special challenge for corporations and businesses in our region. Thanks to generous contributions by local corporations, this unique opportunity supports our grant-making fund to target key community issues and strengthen 3VCF as a philanthropic and geographic anchor. Contact Kelly Bowers, E.d.D., CEO/President at info@3vcf.org .

Additional Giving options

Give, Grant & Grow Green Fund

The Give, Grant & Grow Green Fund fund will specifically support nonprofits and projects providing education, stewardship, and economic opportunities in the green, sustainability, and environmental space.

Impact Diablo Valley Fund

The IMPACT Diablo Valley Fund harnesses the power of collective giving by bringing families together who are interested in learning about the needs in our community, local nonprofits, and how philanthropy can make a huge impact to those around us.

KKIQ Stuff the Bus for Toys for Tots Fund

100% of all KKIQ Stuff the Bus for Toys for Tots Fund proceeds will go directly to the Livermore-Pleasanton Firefighters Foundation Toy Drive to provide holiday gifts for underserved and foster youth in our local community.

Sunol Relief and Recovery Fund

The Sunol Relief and Recovery Fund will support the long-term needs of the Sunol Glen School, local businesses and community residents, following the unprecedented early 2023 rains and flooding that hit the greater SF Bay Area.

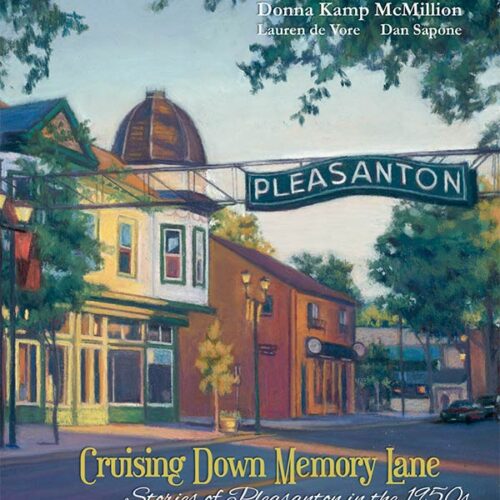

Stories from Pleasanton’s Past: Powering the Future

The civic-minded visionaries behind a new book, Cruising Down Memory Lane: Stories of Pleasanton in the 50’s, in partnership with Three Valleys Community Foundation, are pleased to launch a special philanthropic opportunity that chronicles Pleasanton’s unique history through storytelling while empowering and activating the voices of our next generation.

Danville Area Chamber Youth Mental Health Initiative

The Danville Area Chamber of Commerce, in partnership with Three Valleys Community Foundation, is pleased to launch a special philanthropic opportunity to address mental health and wellness challenges for youth in the greater Danville/San Ramon Valley region.

Danville Area Chamber of Commerce Fund

The Danville Area Chamber of Commerce Fund is a fiscal agency fund at 3VCF established for charitable and educational activities in support of the greater community good.

Other Ways to Give

Mail a check

We welcome checks made out to Three Valleys Community Foundation. Please mail your donation to this address:

Three Valleys Community Foundation

5960 Inglewood Drive, Suite 201

Pleasanton, CA 94588-8611

Three Valleys Community Foundation is also able to accept gifts of marketable securities such as publicly traded stock, mutual funds, etc. as well as gifts via wire transfer. For assistance, or to open a donor advised fund, field of interest or agency fund, please contact Kelly Bowers, CEO at kbowers@3vcf.org

Donor Advised Fund (DAF)

A Donor Advised Fund (DAF) is a philanthropic account that enables donors to contribute funds, receive a tax deduction, and suggest charitable donations from the fund to their preferred 501c3 public charity over time. If you have a DAF, you can recommend grants to Three Valleys Community Foundation.

- Select Three Valleys Community Foundation as your DAF transfer recipient / grantee.

- Input donation amount.

- Designate a purpose – ‘Where the Need is Greatest’.

Opening a Donor Advised Fund (DAF) through 3VCF presents an opportunity for you, the donor, to amplify your charitable impact in our Tri-Valley community. As a 501c3 nonprofit, Three Valleys provides an immediate tax deduction via our organization and recommends gifts over an extended period of time. As a fundholder, you then have the opportunity to recommend ‘secondary’ allocations to nonprofits of your choice, either immediately or over time. DAFs are ideal opportunities for individuals who may want to make an immediate charitable contribution, but may not know all of the eventual intended recipients. Three Valleys can help provide a ‘concierge’ approach, working with your specific interests and focus areas to ensure alignment. Gifts can be earmarked in advance over a period of time. Both endowed and non-endowed DAF options are available, with a variety of investment options to help your corpus grow.

3VCF has identified a number of well-qualified investment pools to select from, allowing our donors to align their financial goals, risk tolerance, and planned charitable giving. Three Valleys can also work with you or your financial advisor to accept stocks, fund transfers or even complex gifts like real estate to open up a DAF. We encourage you to reach out to Kelly Bowers at kbowers@3vcf.org for further information and to explore DAF options. We’re happy to talk it through with you!Employer Matching

Employer Matching

Many companies match employee and retiree donations, increasing the impact of your gift. As a tax-exempt 501c3 organization, Three Valleys Community Foundation qualifies for matching gifts. Contact your Human Resources department to see if your employer participates. Thank you for considering a matching gift to amplify your generosity.

Wiring Funds, Stock Transfers, & Legacy Giving

We are pleased to assist you in creating a charitable giving plan tailored to your needs and interests. If you have questions or would like to discuss specific aspects of your donation, please contact Kelly Bowers at kbowers@3vcf.org

Three Valleys Community Foundation (3VCF) is an IRS recognized non-profit organization. Donations and gifts are fully deductible to the extent of the law. Federal Tax ID # 87-1782380. In addition, 3VCF is a member of the Council of Foundations and when eligible, will be applying for National Standards and Accreditation, which represents a community foundation’s commitment to accountability, meeting applicable federal and state requirements and excellence to communities, policymakers and the public.